Over the last decade, mutual funds have become a very popular investment option in India. A huge number of people are investing their money in mutual funds every month. India has now become the second largest mutual fund industry in the world with more than $400 billion in assets under management (AUM) and is also one of the fastest growing markets in the world. People are investing in mutual funds to achieve financial goals like retirement planning, children’s higher education provision, building a corpus for buying a home and many more. It is the most common investment tool for household savings.

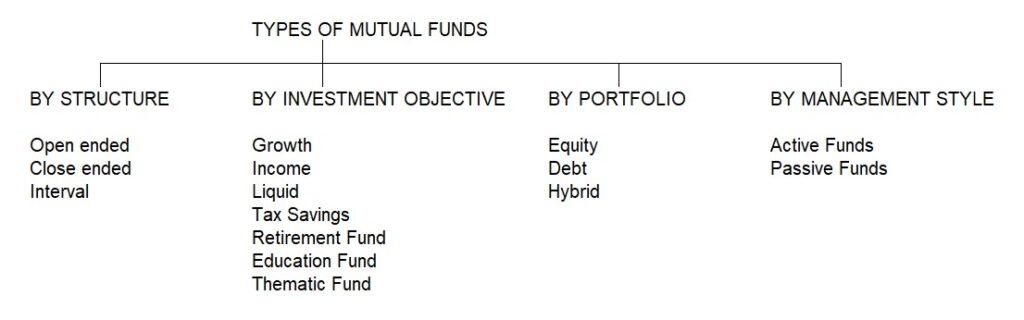

There are a variety of mutual funds out there in the market which meet different investor goals or financial goals. We have covered how mutual funds work, their advantages and disadvantages previously. In todays article we will explore the various types of mutual funds.

I. Based on Structure

- Open ended schemes – these are perpetual and open for subscription and repurchase on a continuous basis on all business days at the current NAV.

- Close ended schemes – In these schemes, the mutual fund units are issued at the time of the initial offer and redeemed only on maturity. The units of close-ended schemes are mandatorily listed to provide exit route before maturity and can be sold/traded on the stock exchanges.

- Interval schemes – these allow purchase and redemption during specified transaction periods (intervals). The transaction period has to be for a minimum of 2 days and there should be at least a 15-day gap between two transaction periods. The units of interval schemes are also mandatorily listed on the stock exchanges.

II. Based on Investment Objective

- Growth Funds – these are designed to provide capital appreciation. These funds invest money mostly in equities. These funds are suitable for medium and long term investment period.

- Income Funds – these provide steady and regular income to investors. These funds invest money in fixed income securities like bonds and government securities. The interest income earned on these investments is the funds income which is distributed to the investors.

- Liquid Funds – these are funds which invest in money market instruments like treasury bills, government securities, commercial bills etc. with maturities not exceeding 91 days. These funds offer liquidity and principal protection along with reasonable returns. These funds are an ideal option to park surplus funds for short periods.

- Tax Saving Funds – these are equity linked saving schemes (ELSS) which offer wealth maximisation and also tax savings. However these funds have a lock-in period of three years. These funds are best suited for salaried investors.

- Retirement Funds – These funds have a lock in period of minimum 5 years or till the retirement age whichever is earlier.

- Children’s Education Fund – These funds have a lock in period of minimum 5 years or till the child attains age of majority whichever is earlier.

- Thematic Funds – These funds are based on a certain theme and invests money in stocks which align with the theme. Eg. ABC IT fund would invest money in all IT sector companies.

III. Based on Investment Portfolio

- Equity Funds – these funds invest money in stocks of different listed companies from various sectors. The stocks could be large cap, midcap or small cap. Equity funds have the potential to generate significant returns over a period of time.

- Debt Funds – these funds invest in securities like treasury bills, bonds and securities. They invest in fixed income instruments like Gilt Funds, Fixed Maturity Plans (FMPs), Liquid Funds, Short-Term Plans, Long-Term Bonds etc. These investments come with a fixed interest rate and maturity date. These funds are a good option for regular income (interest and capital appreciation) with minimal risks.

- Hybrid Funds – these funds invest in both, stocks and bonds, in a fixed or variable ratio. Hybrid funds are suitable for investors who have a risk taking appetite for ‘debt plus returns’ benefit.

IV. Based on Portfolio Management Style

- Active Funds – Here, the Fund Manager is ‘Active’ in deciding whether to Buy, Hold, or Sell the underlying securities and in stock selection. The investment strategy and style are described upfront in the Scheme Information document (offer document). Active funds generally expect to generate better returns than the benchmark index.

- Passive Funds – In these funds, the stock selection / Buy, Hold, Sell decision is driven by the Benchmark Index. Index funds and Exchange Traded funds are passive funds. Stocks are identified along with their corresponding ratio in the market index and and the money is put in similar proportion in similar stocks. The fund manager does not build any investment strategy in passive funds.