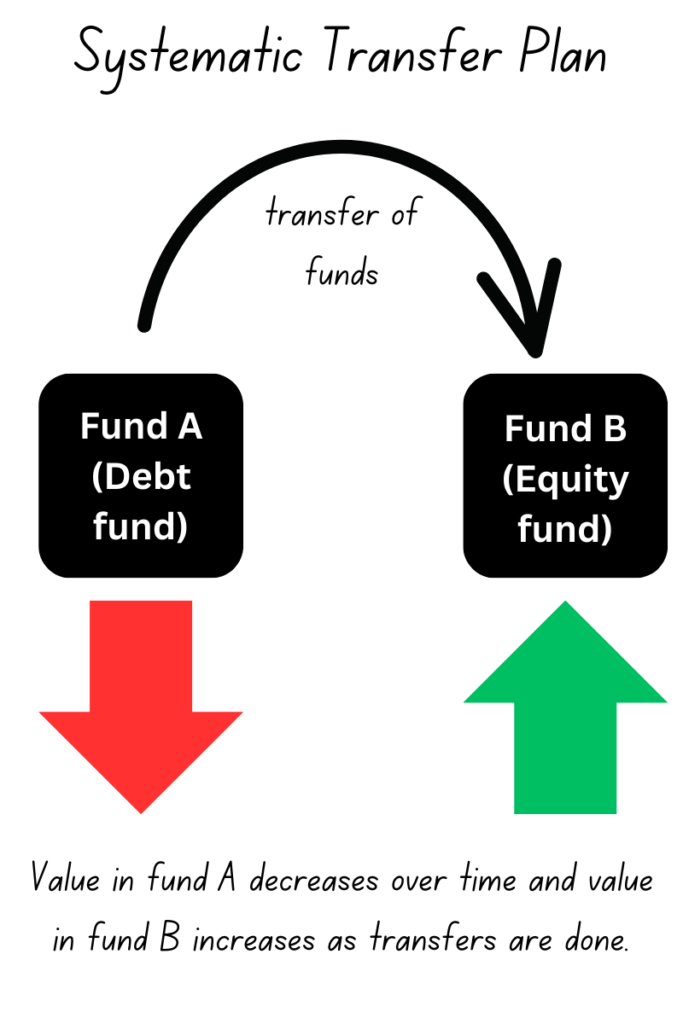

A systematic transfer plan (STP) allows the investor to transfer funds from one mutual fund scheme to another scheme very conveniently. It involves moving a pre-determined amount at periodic intervals from one scheme to another. By using STP, the investor can take the advantage of schemes in different asset classes to earn higher returns. Generally, we observe many STP’s between equity and debt mutual funds.

A systematic transfer plan can only shift investors money between various funds operated by a single fund house. Transfer between multiple schemes offered by various fund houses cannot be done. eg. A STP can be used to transfer funds between equity and debt mutual funds operated by XYZ fund house. You cannot use a STP to transfer funds between debt fund of ABC fund house and equity fund of XYZ fund house.

How Systematic Transfer Plan (STP) works?

Let us understand STP with an example. Kiran has an amount of Rs 20 lakhs which he wants to invest in a mutual fund. Currently equity markets are very volatile. Kiran does not want to invest the entire amount in equity. He invests the total amount in a debt mutual fund. He setup a STP of Rs 10,000 monthly to an equity mutual fund. So here Rs 10,000 will be transferred from the debt fund to the equity fund each month. By doing this Kiran will earn interest income on the debt fund and will also get the benefit of the equity markets over a long term period.

Types of STP

There are 3 types of STP

- Flexible STP – The total funds to be transferred are determined by investor as and when the need arises. Depending upon market volatility and calculated predictions about the performance of a scheme, an investor may want to transfer a relatively higher share of his/her existing fund, or vice-versa.

- Fixed STP – The total amount to be transferred from one mutual fund to another remains fixed as decided by the investor.

- Capital STP – These transfer the total gains made from market appreciation of a fund to another prospective scheme with a high potential for growth.

Benefits of STP

- Rupee cost averaging – Like SIP, STP also helps in bringing rupee cost averaging. Suppose there is a STP from debt fund to equity fund, then amount will be transferred to the equity fund at regular intervals. So the investor will get more units when the market is low and less units when the market is high, thereby averaging out the investment cost.

- Higher returns – In a STP between debt and equity funds, you will earn interest on the amount invested in debt fund and there will be equity appreciation for funds held in the equity fund in the long term. So in the long term, you will earn higher returns.

- Risk and portfolio diversification – With a STP, you invest money in different asset classes like debt and equity. This reduces the risk and also helps to diversify investment portfolio.

Taxation of STP in India

- Every transfer from one fund to another fund is considered a ‘redemption’. The redemption of mutual funds attracts capital gain tax.

- If amount is transferred from debt fund before the end of three years it will be considered as a short term capital gain and taxed at the applicable rates.

- If the transfer is from an equity fund before the end of one year, it will be considered a short term capital gain and taxed accordingly.