Most people want to save money but don’t have a concrete plan of how they want to achieve it. While earning money is important, saving money is critical for living a financially comfortable life. You need a solid plan and financial discipline to stick to your plan in order to save money. Today we will look at ways to develop the habit of saving money. If you are able to save money, you can build an emergency fund. Savings can help you sail past difficult times like hospitalization of family member, job loss etc. It also helps to achieve long term goals like buying a house, providing for child education, starting a business etc.

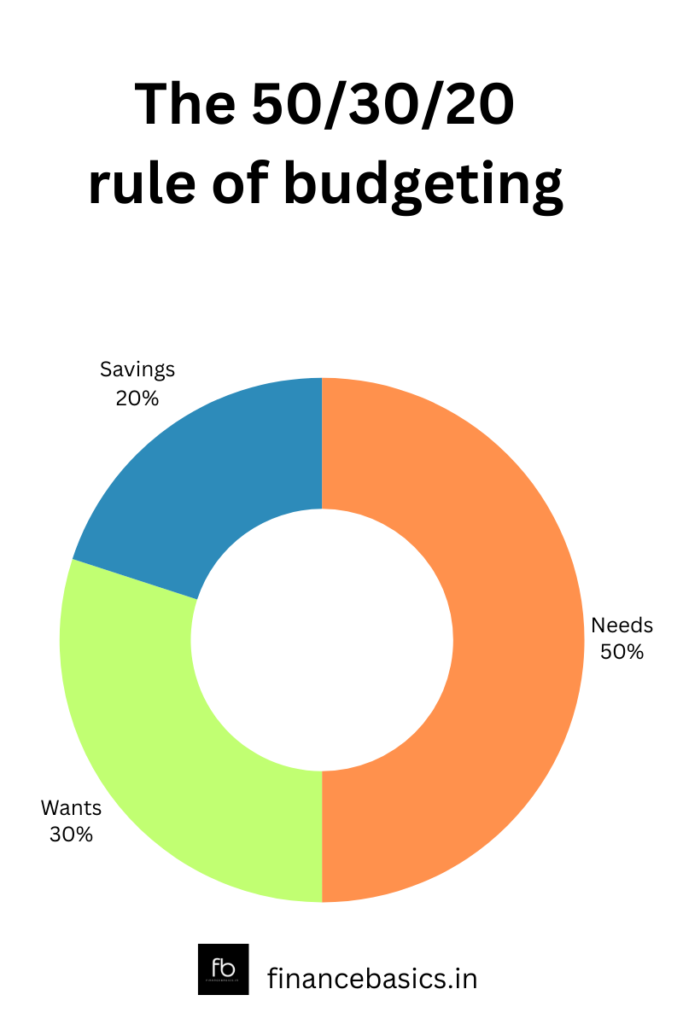

1. The 50/30/20 rule of budgeting

Suppose Minnie is earning Rs 50,000 after tax monthly. If Minnie follows the 50/30/20 rule she will split her monthly income after tax as follows:

- 50% on needs: Minnie will set aside Rs 25,000 (50% of Rs 50,000) for her monthly needs. She has to ensure she meets all her monthly essential expense in this amount. This would include all utility bills, groceries, loan EMI’s, insurance premiums etc.

- 30% on wants: Suppose Minnie wants to buy a smartwatch or wants to have lunch at the new restaurant, she will set aside Rs 15,000 (30% of Rs 50,000)

- 20% on savings: Minnie will set aside Rs 10,000 (20% of Rs 50,000) as savings.

It is important to follow the above rule in the reverse direction. Once you receive your monthly income, set aside the savings amount first. Target to spend only the remaining amount during the month. At any point in time, you need to save at least 20% of your monthly income after tax.

2. Spend less than you earn

Many people struggle to control their spending. In these times of instant gratification and impulsive buying, we can end up spending way more than we should and may end up in debt. Be conscious of your spending activity. Think and analyze whether you really need a product before you buy it. Change your lifestyle to ensure you are not making any unwarranted spends – like eating out daily, shopping online every few days, buying a smartphone which you can’t afford etc.

3. Set up automatic transfers

Add automatic monthly transfer instructions in your salary bank account, so you can park the savings funds immediately after the salary day/pay day. We mean setting up auto-debit instructions in your salary account and transferring the money in your savings or fixed deposit account or liquid mutual fund.

4. Track your finances

It is important to track your monthly expense v/s the budget. Initially you may struggle to limit expense within the budget. However with consistent tracking you will be able to identify areas where you end up spending significant money. You can then look at alternatives to these expenses or may want to pull a plug on them entirely. Tracking helps to save more money in the long term.

5. Set aside or park any additional income

You should set aside any additional income like performance bonus, sales commission, sales bonus, gains from investments and invest these amounts so that your additional money can grow even more. As they say, money saved is money earned.

Cultivating the Habit of Saving is one of the fundamental cornerstones in the journey of financial independence. Small savings each month have the potential to grow and create huge wealth over a period of time. The key here is to start saving early, ideally from your very first payday. Initially when income is low, saving 20% feels like a tall order. However, we recommend you still save the amount no matter how tough it seems. As you gain work experience, income grows and saving the same 20% feels like a breeze. Please note, that with increasing income, your savings should also increase proportionately and should NOT remain at 20% of income. It should be much more.