A bull market is a condition of the financial market where prices are rising or are expected to rise for extended periods of time. The common definition of a bull market is where stock prices or indexes have increased 20% from recent lows.

Bull markets generally occur when the economy is strengthening or is already strong. A bull market would occur in a period when the Gross Domestic Product (GDP) is strong, there is low unemployment, greater investor confidence, rising per capita income of the people, rise in business/corporate profits. So a bull market normally coincides with a booming economy.

Phases of a Bull Market

The bull market has three phases.

- Phase 1 – Accumulation: It typically comes at the end of a downtrend when the markets bottom out. The accumulation phase is always hard to spot. There is a period of price consolidation at the beginning of the accumulation phase and later the prices start moving upward.

- Phase 2 – Participation: In this phase the business conditions improve, economy improves and the negative outlook fades away. Investors start buying stocks which causes the prices to increase. The participation phase is normally the longest phase of a bull market and also the one with the largest price movements.

- Phase 3 – Excess: Here alert investors reduce their positions and book profits. By the time this phase is reached, the alert investor would have already made the largest profits that the bull market had to offer. The buyers who enter the market at this stage, do so after the big gains have already been achieved and end up buying stocks at a very high price. If the upward trend starts to peter out, it may be a sign of the onset of a bear market.

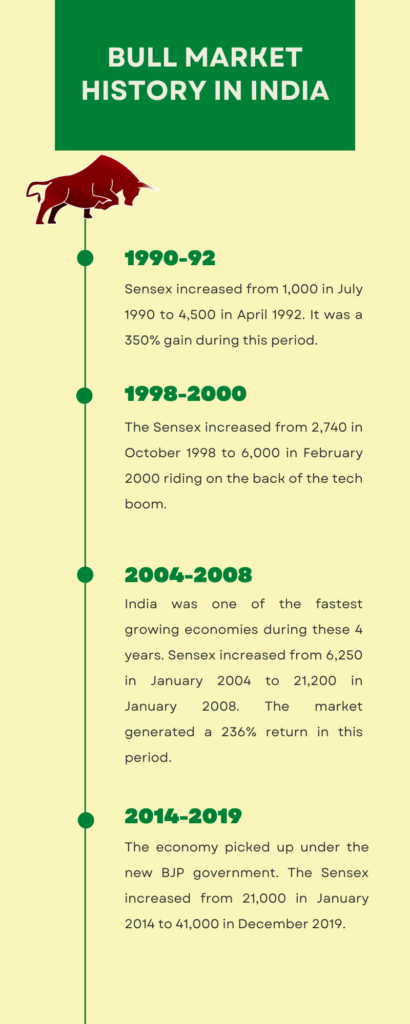

History of Bull Markets in Indian Stock Market

What should investors do in a bull market?

- A bull market is a good opportunity to invest money and book profits.

- To get the best benefit of a bull market, investors should buy early to take advantage of rising prices and sell when the price reaches the peak.

- A ‘buy and hold’ strategy works best in a bull market. The idea is to buy a stock and hold it with an intention of selling it at a future date when the stock price increases.

- ‘Increased buy and hold’ strategy is used by seasoned investors where they continue to buy stock as long as the stock price increases.

- Investors can invest in large cap companies to get the benefit of periodic dividend pay-outs.

- Investors can also invest in small and mid-cap companies and book profits as the stock prices increase.