So you decided to buy a car and want to calculate a budget. You think of all the features that you want in your new car. Leather seats. 360 camera. Rear window wiper. 6 airbags. ABS and EBD. Alloy Wheels. Automatic transmission. Hybrid engine. As you list down the features, the price of the car variant goes on increasing. You may end up paying a bomb for a new car in the end. In the past few years the Indian car market has seen a shift in spending. The prices of cars have also increased. A decent car with most of the features mentioned above would cost around or above Rs 10 lakhs today. So now the question is, how much should you budget to buy a car? Below are a few pointers to bear in mind while buying a car.

1.Thumb Rules

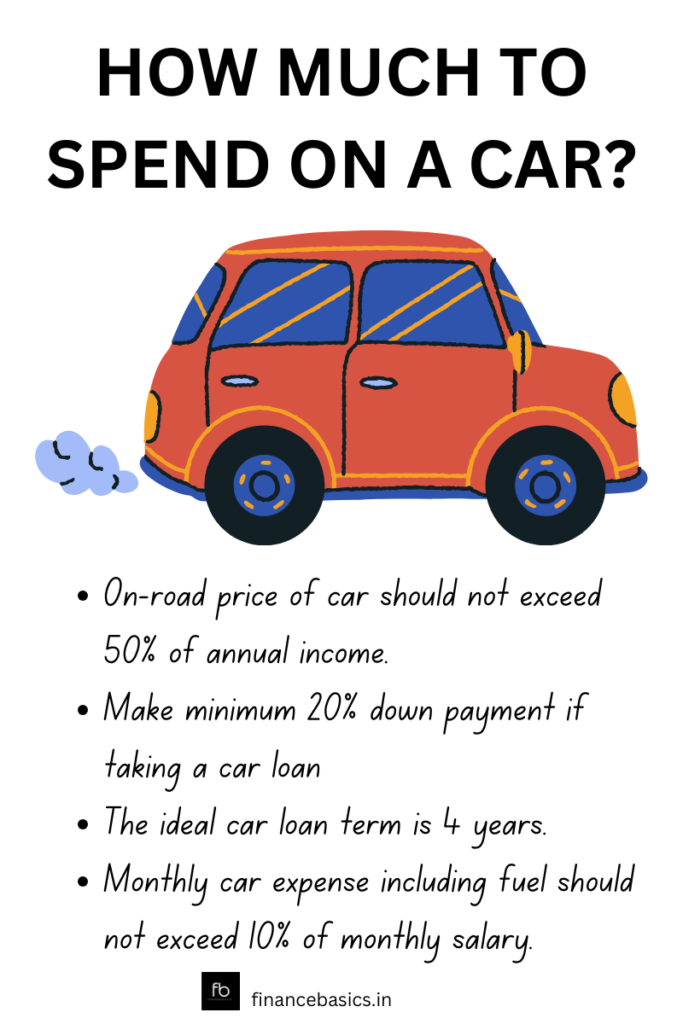

- Never spend more than 50% of your annual income on a car. If your annual income is Rs 14 lakhs, then your maxed out budget for the car should be Rs 7 lakhs. Please note, the on-road price of the car should be Rs 7 lakhs or less. The on-road price of a car is all inclusive and includes registration charges, insurance premium etc.

If you are taking a car loan, follow the 20/4/10 rule.

- You need to make a down payment of atleast 20% of the on-road car price. If you are able to make a bigger down payment it is always better.

- The term of the car loan should not exceed 4 years.

- Do not spend more than 10% of your monthly income on car maintenance, insurance premium, fuel charges etc. eg: If your income is Rs 90,000 per month, then the car expense should not exceed Rs 9,000 monthly.

2.Existing Debt

If you have existing debt like home loan, then your car budget would undergo a substantial reduction. While deciding on the car budget, factor in the impact of any existing loans. Just because you have a pre-approved car loan of Rs 25 lakhs doesn’t mean you can afford it in reality. The higher the loan amount, the higher is the interest expense on the car.

3.Do not compromise on monthly savings

A car purchase should not eat into your monthly savings. You need to set aside the monthly savings amount first and then arrive at the amount available for buying a car. In any situation, your car EMI should only be around 10% of your total monthly savings. If this is not achievable, hold off buying a car until your financial position improves.

4.Car Insurance Premium

Car insurance premium is one of the major expenses of owning a car. Generally higher the price of the car, greater is the insurance premium amount. You need to keep in mind the annual insurance premium while drawing out a car buying budget.

5.Pick the right car size

Select a car which suits your current requirements. Suppose you have a family of three people, a hatchback or a sedan may be a better choice. If you stay in a big family or have pets, a multi utility vehicle may be appropriate for you. If you intend to drive the car only in the city for majority of the time, a small car would make more sense. A SUV may be a better choice, where you plan to go on road trips frequently. The bigger the car, the more expensive it gets. So choose as per your current needs, not as per your wants.

To conclude, no matter which car you buy, remember it is a depreciating asset. The minute the car leaves the showroom its price drops by 5%. The cars value falls to nearly 45% of the buying price in five years time. So it makes sense to buy a safe, fuel efficient car which you can easily afford and whose maintenance is easy on the pocket.