Mutual funds are one of the most popular investment tools available in India today. There are a plethora of mutual fund schemes available for investment and choosing one can be a daunting task. There is no right or wrong answer while picking a mutual fund scheme. It is entirely subjective and changes from person to person. This article aims to provide a few key parameters to look at while picking a mutual fund to invest in. The idea is to help you make a more informed investment decision.

Goal of investment

You need to be clear on the goal of investment or the purpose of investing money. A goal could be short term like planning a vacation abroad, tax savings or long term like accumulating money for children’s college education. The investment goal will influence the type of mutual fund scheme you invest in.

Risk appetite

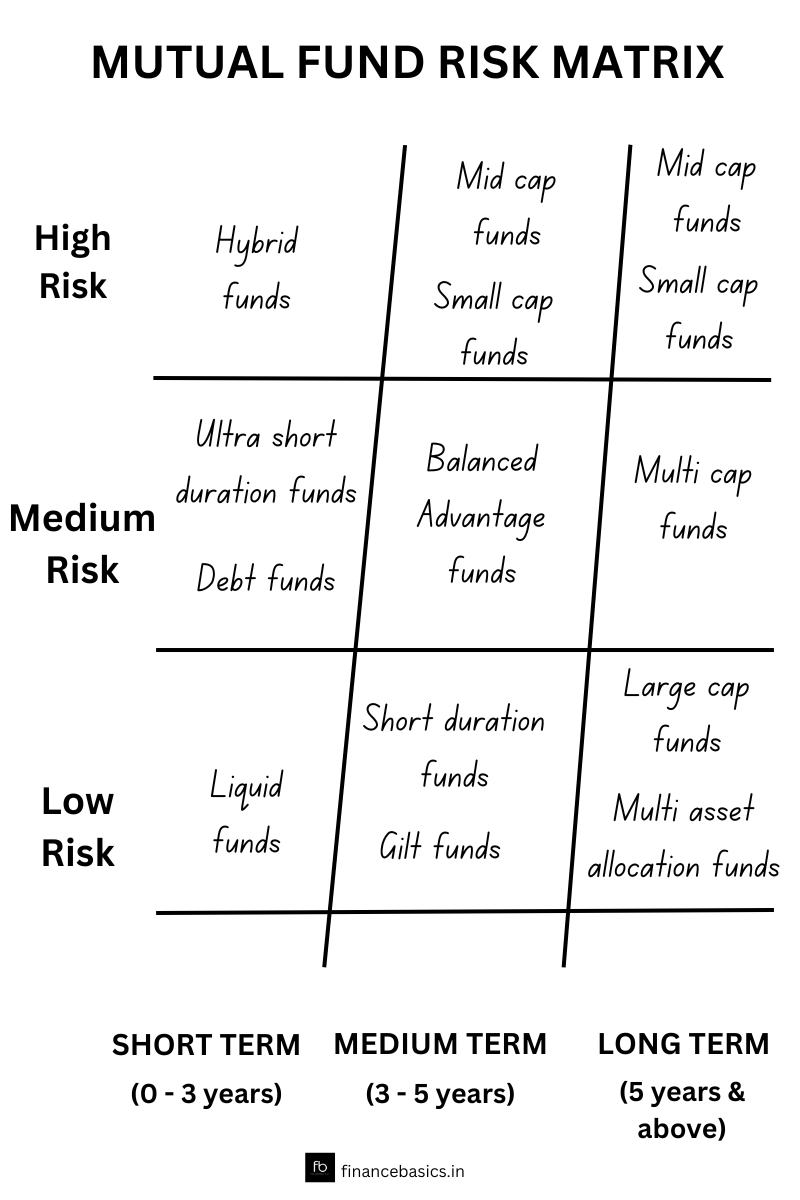

The next important parameter is your risk appetite i.e. how much risk are you willing to take to make higher returns. The answer to this question will significantly impact the type of mutual fund schemes you are likely to invest in. Mid cap and small cap funds are generally high risk. Large cap funds are low risk schemes. The below table broadly categorizes each type of mutual fund into risk bands.

Liquidity

Investors should have an idea of when they might need the invested money. If you only want to park funds for a short period (i.e 0 to 6 months), liquid funds are a suitable option. For a short or mid-term investment (i.e 0 to 3 years or 3 to 5 years), hybrid funds are an appropriate choice. If you are saving money for long term goals like retirement or child education, equity funds are a good investment choice. The amount invested in equity tends to compound at a fast pace over a period of time.

Fund Performance

Fund performance has to be considered over a reasonable time frame. Funds which have been generating consistent returns and are beating their benchmark over a three, five, seven and ten year period are generally a good investment choice. It is important to check the details regarding the fund manager and the investment portfolio held by the mutual fund scheme. All this information is freely available for investors on the website of the mutual fund house.

Exit Load and Expense ratio

The exit load is a fee charged by mutual fund houses when investors exit a mutual fund scheme within a short period of time. The expense ratio is a fee charged by mutual fund houses for managing the investors investments. An investor should be aware of the exit load and expense ratio of a mutual fund scheme and should target funds which have minimal or zero exit load and low expense ratio. This would ensure better net returns to the investor.

Irrespective of which mutual fund you choose to invest, it is important to periodically review the current value of the investment v/s the invested amount. If the investment is not doing well consistently over a period of time, it is important to switch the investment to a better performing mutual fund.