A mutual fund is a pool of money collected from investors, which is then invested in equities, bonds, money market instruments and other securities. The income/gains generated from these investments are distributed proportionately amongst the investors after deducting applicable expenses and fees. The fees and expenses charged by the mutual funds are regulated and are subject to the limits specified by SEBI. Mutual funds are managed by professional Fund managers who have the expertise in analysing and managing investments.

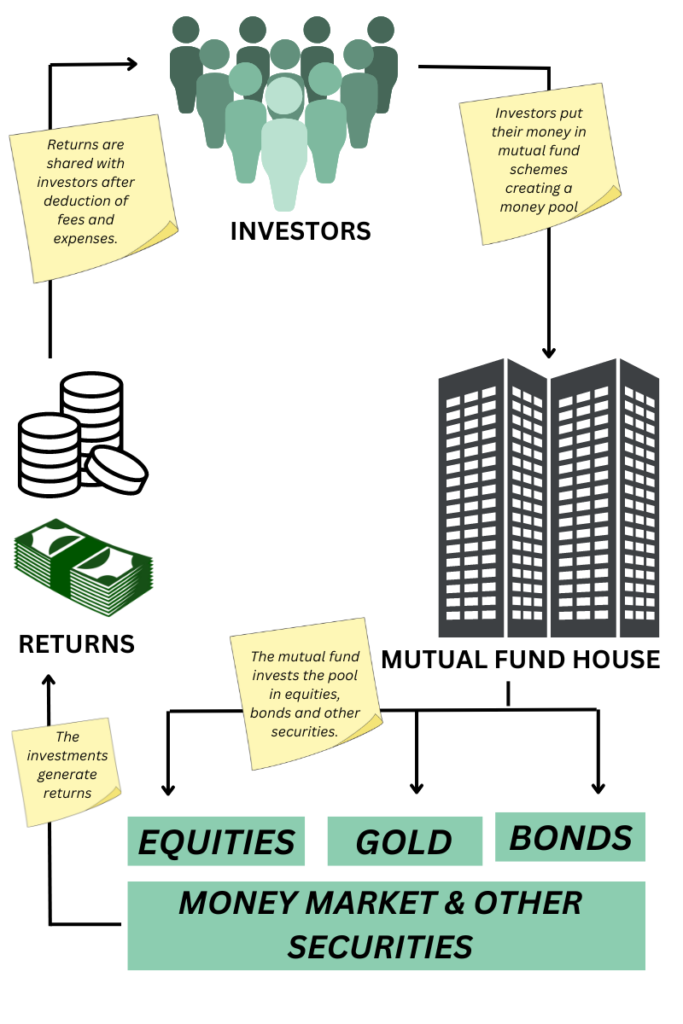

How mutual funds work?

- Investors buy units in the mutual fund by putting their money.

- The mutual fund house invests this money in financial instruments like equities, bonds, money market instruments etc.

- These investments generate returns in the form of dividends, interest and gains. These returns are paid back to the investors who can choose to reinvest them.

- Investors can pull their cash out of the mutual fund at anytime.

Advantages of Mutual Funds

- Managed by Fund managers – The mutual fund house appoints fund managers, to manage the mutual funds in India. These managers have the knowledge and expertise to identify the best stocks which can generate maximum profits.

- Diversification – The money in mutual funds is invested in multiple stocks from various sectors like FMCG, automobiles, pharmaceuticals, IT etc. So the loss incurred on stocks in one sector can be offset by profits made on stocks in other sectors.

- Liquidity – Mutual funds are considered to be highly liquid as these can be easily bought and sold during market hours. However, some funds like equity linked savings scheme (ELSS) are an exception, as they have a specified lock-in period and cannot be easily liquidated.

- Convenient & Affordable – For many investors, buying individual shares of companies is not affordable. You can invest in mutual funds with a minimum amount of Rs 500. Also you can invest in mutual funds online. This makes mutual funds a very affordable and convenient investing option.

- Tax Benefits – Investing in mutual funds in India via the equity market offers tax benefits. The investments made in ELSS are exempted under Section 80C of the Income Tax Act, up to Rs. 1.5 lakhs.

- Low Operating Cost – Due to very large economies of scale the mutual funds tend to have a low operating cost compared to the net assets of the fund.

- Regulated – Mutual Funds are regulated by the capital markets regulator, Securities and Exchange Board of India (SEBI). SEBI has laid down stringent rules and regulations keeping investor protection, transparency with appropriate risk mitigation framework and fair valuation principles.

Disadvantages of Mutual Funds

- Costs – Costs can also be a disadvantage. Some mutual funds in India have high costs associated with them. Also in some funds, if you exit before a pre-determined time period you will have to incur exit charges or exit load.

- Diversification of Funds – diversification can be a disadvantage as sometimes it can prevent you from making huge profits. Some sectors give huge gains so not investing in them can be a loss of profit making opportunity.

- Fluctuating Returns – Mutual fund returns fluctuate according to the market conditions. Also there is no guarantee of making profits. Investors must be aware of the risks involved before investing in mutual funds.

- Lock in period liquidity issues – In a lock-in period of a mutual fund you cannot withdraw your money before the specified time. You cannot liquidate your investments in such mutual funds in case of emergencies.

Image credit: Image by Freepik