Amit recently got his first job. When he received the appointment letter it mentioned a CTC of Rs 12 lakhs. Amit was delighted with the package offered to him and immediately set about calculating his monthly salary. Amit did a simple math Rs 12 lakhs / 12 and arrived at a monthly salary of Rs 1 lakh. He was over the moon when he calculated the amount. One month into his job, it was salary day. He was eagerly waiting for the message to arrive on his cellphone. The message from the bank arrived. Amit had received Rs 70,000 in his bank account. Amit was flabbergasted when he saw the amount. He was expecting Rs 1 lakh and couldn’t understand why it was less. A lot of us would be able to relate to Amit. In today’s topic we will understand what is CTC, take home pay and the points to remember while evaluating a job offer.

Cost to Company (CTC)

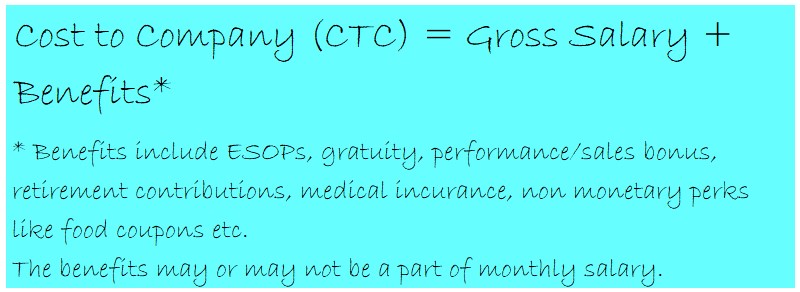

Cost to Company (CTC) is literally speaking the ‘total cost that a company bears for an employee’. So CTC includes all the salary components like basic, house rent allowance, perks, provident fund contribution, gratuity etc. It also includes other components which may not be a part of monthly salary like medical insurance, employee stock options, performance bonus etc. It includes deductions too which are paid directly to Employee Provident Fund Organization or Income Tax department. All these factors make the CTC look inflated.

Take Home Salary

Take home salary is the salary which is deposited in your bank account. This salary is the amount after all deductions are made. Generally take home salary is 20 to 30% lower than your CTC. Take home salary is the amount available for you to spend, save and invest. All financial decisions should be based on your take home salary. If you are planning to take a loan always check the affordability based on your take home salary.

Coming back to our earlier example, Amit’s take home salary was Rs 70,000. This amount was after deduction of PF contribution Rs 12,000 and taxes Rs 18,000. So amount of Rs 70,000 was credited to his bank account.

Points to remember while evaluating an offer

- Go through the components of Cost to Company (CTC) in detail.

- Always seek clarity on the take home salary amount.

- Incase of stock options, be informed of the vesting period and the duration available for exercising the options.

- Be informed of all the non monetary perks/components of your CTC so you can utilize them.

It is natural to feel over the moon when you get a big number package. However, one needs to bear in mind that the ‘offer amount’ is not the ‘actual amount’ that you will get in your bank account. It is important to understand and know the ‘take home salary’ as this is what you will get every month in your bank account. All your financial decisions will be driven by your take home salary.