Table of Contents

What is UPI?

UPI means ‘Unified Payments Interface’. It is a smartphone payment system which enables instant transfer of funds between bank accounts. Launched by National Payments Corporation of India (NPCI) in April 2016, UPI is regulated by the Reserve Bank of India. It is the most widely used real time payment system in the world.

Unique Features of UPI

UPI is a revolutionary, user friendly, real time payment system and is one of its kind. Lets look at what makes UPI so unique worldwide.

- Instant money transfer through smartphone round the clock 24*7 and 365 days.

- Free of cost bank transactions.

- Single mobile application to access multiple bank accounts

- Single click2factor authentication – aligned with regulatory guidelines that also provides a feature of single click payment.

- Customer has a virtual address and is not required to enter bank account number, card number etc.

- QR code

- Merchant payments, utility bill payments, over the counter payments, QR code based payments (scan & pay) are possible

- Collection of money, requesting money can be done.

- Complaints can be raised from the mobile application directly

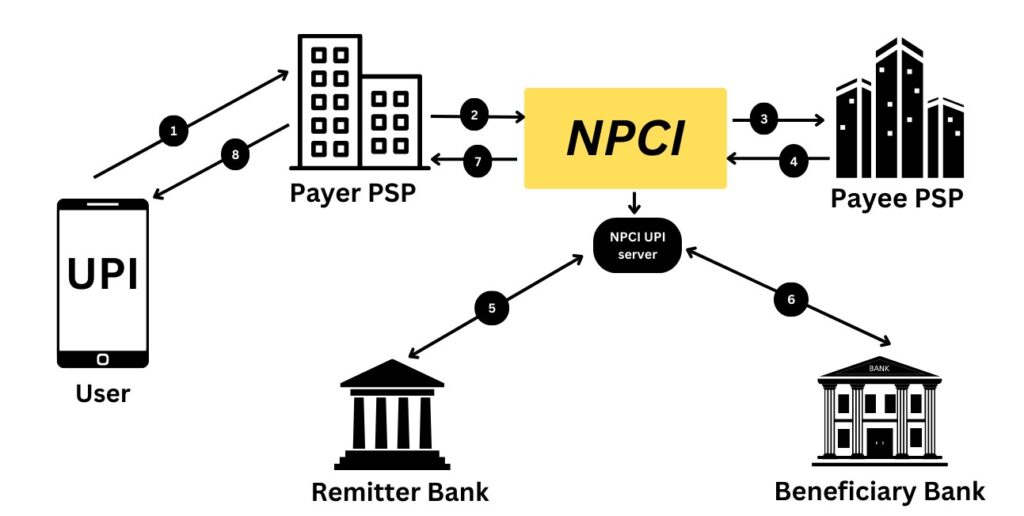

Participants in a UPI transaction

- NPCI – NPCI is the owner, network operator, service provider, and coordinator of the UPI network.

- Payer PSP – These are apps which allow customers to initiate/complete a transaction. eg: Bhim, GPay etc.

- Remitter bank – Funds are transferred from the remitter bank. The users bank account is debited. The remitting bank is also responsible for authenticating the UPI PIN set by the customer.

- Beneficiary bank – Any credit going to a UPI user will be credited to a beneficiary’s bank account. The bank receiving the funds in UPI transactions will be acting as a beneficiary bank.

- Payee PSP – A bank in the role of Payee PSP can onboard a customer/merchant to receive money or raise a collect request. This is also known as a beneficiary/resolving PSP.

- Bank account holders/customers – Any customer who is on-boarded by a bank with a UPI enabled account and a UPI ID can utilize the services.

- Merchants – Participating merchants are those who are on-boarded by their banks to accept UPI enabled payments from customers.

- Corporates – UPI also provides the ability for large technology companies, 3rd party processors, and aggregators to connect to banks and provide extensive services to end consumers.

How UPI works?

There are two types of transactions in UPI, namely ‘Push’ and ‘Pull’. A ‘Push’ transaction is where a payer initiates sending of money to payee. The payer controls the amount, payment and transaction. eg. When you have to pay through the UPI app at the grocery store, you (the payer) initiate the payment. You are in control of the amount, payment and the transaction.

A ‘Pull’ transaction is where money is requested by the payee from the payer. Here, the payee controls the amount, payment and transaction. A payer must give authorisation beforehand for funds to be taken out of the payer’s account. eg. Ola Cabs sends a money request to the customer when he/she needs to pay the cab fare via UPI on the Ola app. This is called a ‘pull’ transaction. Ola Cabs controls the amount, payment and transaction. The customer has to approve the request for the money to be paid to Ola from the customer’s bank account.

We will have a look at how ‘Push’ transactions work which form the majority of transactions on the UPI platform.

- Customer initiates the transaction by scanning a QR code in the Bhim/Google pay/Phonepe app (Payer PSP).

- The Payer PSP will forward the request to NPCI.

- NPCI will forward the same request to the Payee’s PSP for address resolution and authorization. The payee PSP resolves the address and provides the account details (works with the Remitter bank).

- The Payee PSP will provide the bank details to UPI and the same will be forwarded to NPCI.

- NPCI will check with the remitter bank to debit funds from the payer’s account.

- After money gets debited, a credit request is sent to the beneficiary’s bank. The beneficiary bank credits the Payee’s account and later responds to NPCI UPI.

- NPCI UPI server passes the response on the status of the transaction via Payer’s PSP.

- The Payer’s PSP then relays the status of the transaction to the customer.

Benefits of UPI

UPI offers wide benefits for everyone using it namely – customers, merchants, banks.

- Promotes cashless economy – The use of UPI helps to conduct daily financial transactions using digital payment technology. There is no need to have physical cash. It brings transparency in financial transactions and helps to remove the reliance on cash.

- Instant free of cost transactions – The users can make payments and receive money instantly, free of cost. There are no charges to use UPI.

- Secure transactions and privacy protection – UPI does not require the user to enter bank, credit card details while making any payments. There is minimal risk of financial data theft. At the same time the user’s privacy is also protected as UPI makes use of a virtual payment address and there is no visibility on the bank account details.

- Payments for IPO – Users can make payments for IPO subscription through the UPI application.

- Auto-payments facility – Users can schedule auto payments through the UPI application for recurring monthly expense, subscription payments etc. Also, users can pay utility bills, property tax, credit card bills etc. through the UPI application.

- Benefits for merchants – It removes the problem of receiving cash on delivery and facilitates easier fund collection. It is ideal for e-commerce sellers/merchants as it reduces the operating costs in the form of no ‘cash on delivery collection charges’.

Unified Payments Interface (UPI) is a revolutionary payment system which is hugely popular in India. It is super convenient and easy to use. UPI is also accepted as a payment system in countries like France, UAE, Bahrain, Singapore, Maldives, Oman and Bhutan. Indians can make payments through UPI in these countries.