RuPay is a card payment network of India. It is widely accepted at ATM’s, PoS devices and e-commerce websites across India. The name has been coined from the combination of 2 words ‘Rupee’ and ‘Payment’ – RuPay.

RuPay is a product of National Payments Corporation of India (NPCI) and was launched in March 2012. It is a secure electronic payment and settlement system. It was created to fulfill RBI’s vision of a ‘less cash’ or ‘digital economy’. Currently RuPay credit cards and debit cards are issued by all the major Indian banks including SBI, HDFC bank, ICICI Bank, Punjab National Bank, Bank of Baroda etc.

Table of Contents

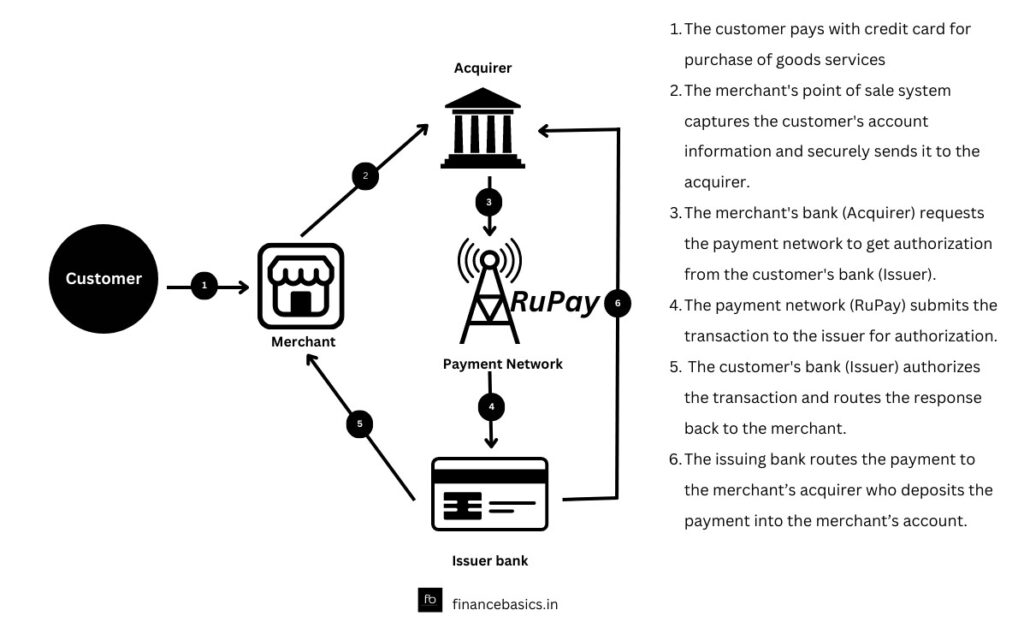

How do RuPay credit cards work?

Why use RuPay cards in India?

As mentioned earlier, RuPay is India’s payment network and was created to promote a digital economy. There are many benefits of using RuPay cards in India namely –

- Widely accepted in India – RuPay cards are accepted at all domestic payment gateways, ATM’s, point of sale machines in India.

- Processing time – RuPay being a domestic payment network, takes less processing time as compared to Visa and Mastercard which are international payment networks.

- Security – RuPay cards are very secure. They come with EMV chip and PIN based security features. These provide greater security against data theft and fraud.

- Transaction fees – RuPay charges lower transaction fees as compared to Visa and Mastercard. This is a big benefit for merchants. Also banks dont have to pay registration charges to avail services of RuPay network unlike the foreign payment networks (Visa & Mastercard).

- Cashbacks, Offers – There are cashback rewards for using RuPay cards. There are also many offers, exclusive deals, discounts on using RuPay cards.

- Linking RuPay credit cards to UPI – Users can link their RuPay credit cards to their UPI ID enabling safe and secure payment transactions through UPI.

How to link RuPay credit card on UPI?

- Open the BHIM UPI app

- Enter passcode

- Click on bank account

- Add account

- Select credit card

- Select credit card issuer bank

- Select the credit card

- Click ‘Confirm’

- Click to ‘view’ accounts

- Select from available options

- Set UPI PIN

- UPI PIN set successfully

How to make payment with RuPay credit card on UPI?

- Scan merchant UPI QR code

- Enter amount and select Credit account

- Select RuPay Credit account followed by UPI PIN

- The completed transaction will appear in the transaction history

RuPay cards are made for India and powered by an Indian payment network. These have been designed with the primary aim of making the Indian economy digital. The features these cards have, meet the daily requirements of the wider Indian population. Moreover due to lower transaction fees, these cards are also affordable to maintain. RuPay cards should be the preferred choice for all Indians who need a card for daily use within the country.